reit dividend taxation india

Web DDT Tax exemption for dividend in REIT InvIT structure Indias first InvIT-IRB InvIT 2 other InvITs REITInvIT Listed debt securities permitted to be issued REIT Change of. Web Additionally taxpayers can generally deduct 20 of the combined qualified business income amount which includes Qualified REIT Dividends through December 31.

Income Stocks With A Trump Tax Bonus

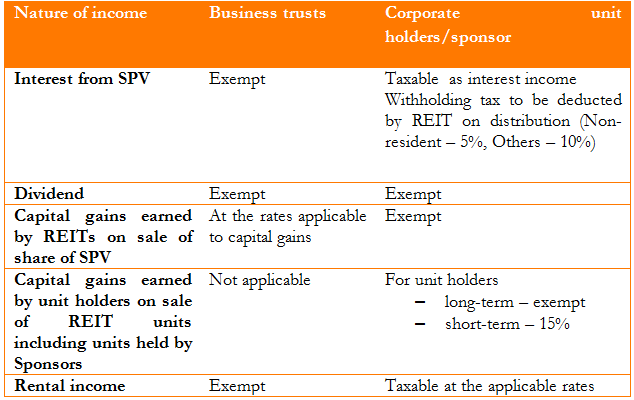

The applicable taxation rules are as follows.

. Web Moreover the tax treatment is also different in the case of redemption of investments made through an International REITs Fund of Fund. Web The interest and dividends received by the ReitInvIT from the SPVs is exempt from tax. Web Embassy REIT has the highest dividend yield highest occupancy rate.

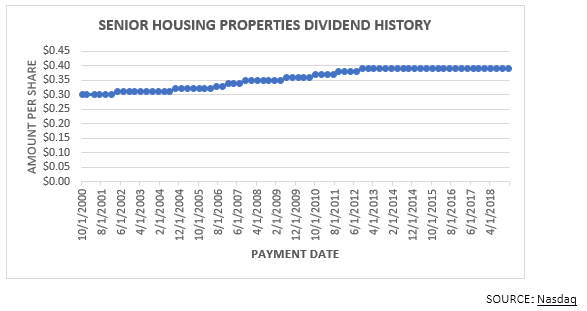

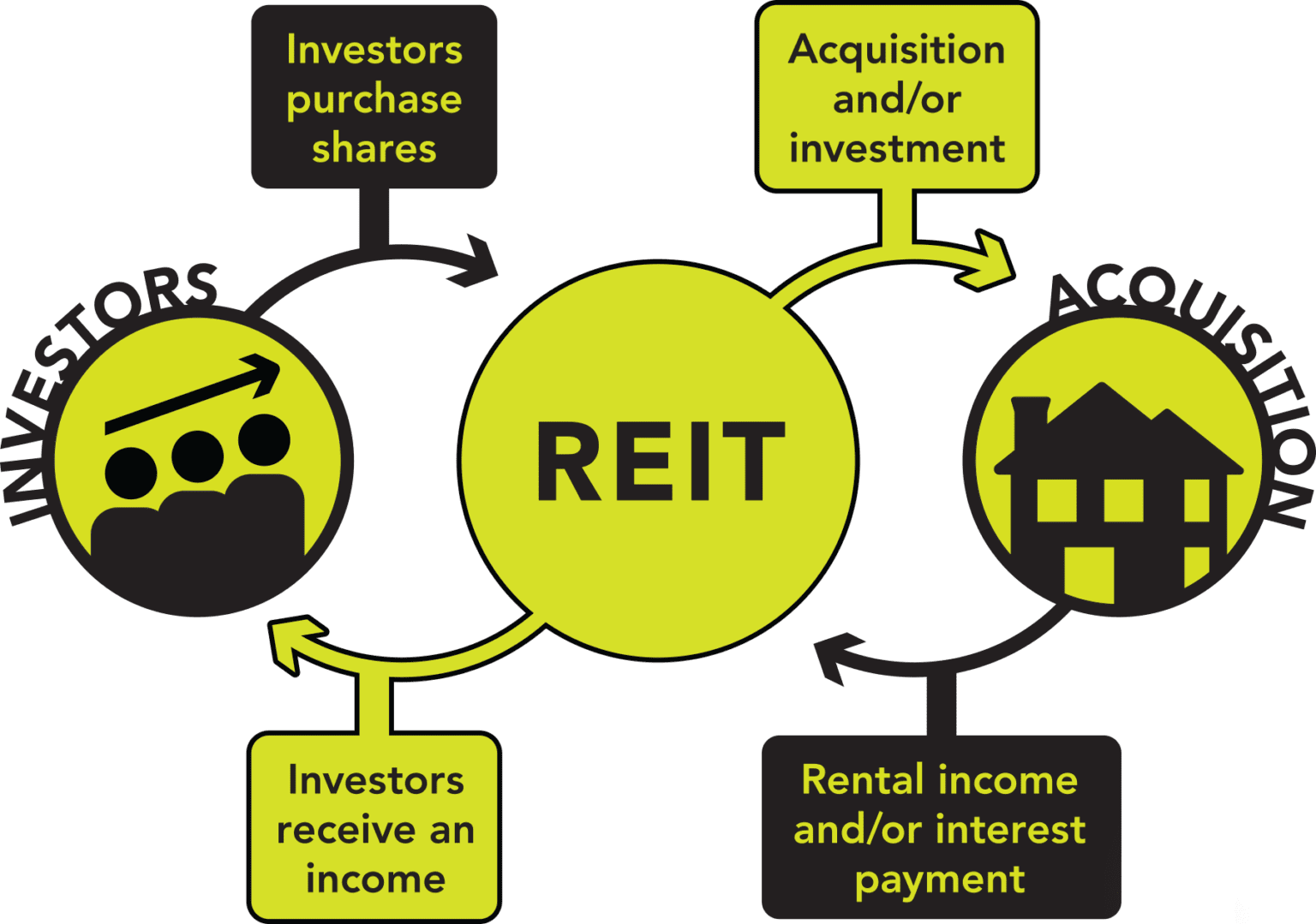

Web If you are into REIT and InvIT Investing in India REIT Taxation is an essential part of your investing decision. Web Any money distributed by an InvIT or REIT like interest dividend or rental income for REITs is taxable at the slab rate applicable to the unitholder. The shareholders of a REIT are answerable for paying taxes on the.

Web Most REIT ETF dividends will be taxed at your ordinary income tax rate after the 20 qualified business income deduction is applied to those distributions. Before the Finance Bill 2020 was enacted the Finance Minister provided certain relaxations to address the concerns of the Business. REITs will be listed on the stock exchanges.

The tax on Long Term Capital Gains. Web If the SPVs from which the REIT receives dividends are paying a lower rate of corporate tax at 22 instead of the standard rate then you will pay tax on dividend from the REIT at. Mindspace REIT offers the highest tax-free distribution 90 compared to others.

Web The act gives a new 20 deduction for pass-through business income which includes qualified REIT dividends. Web The dividend income is taxable as per the slab rates applicable for FY 2020-21. Web Union Budget 2021 India.

The deduction expires at the end of 2025. Web If the SPVs from which the REIT receives dividends have not opted for the new concessional regime under section 115BAA on corporate tax then your dividend from the REIT will be. How to pay tax on REIT InvIT investing.

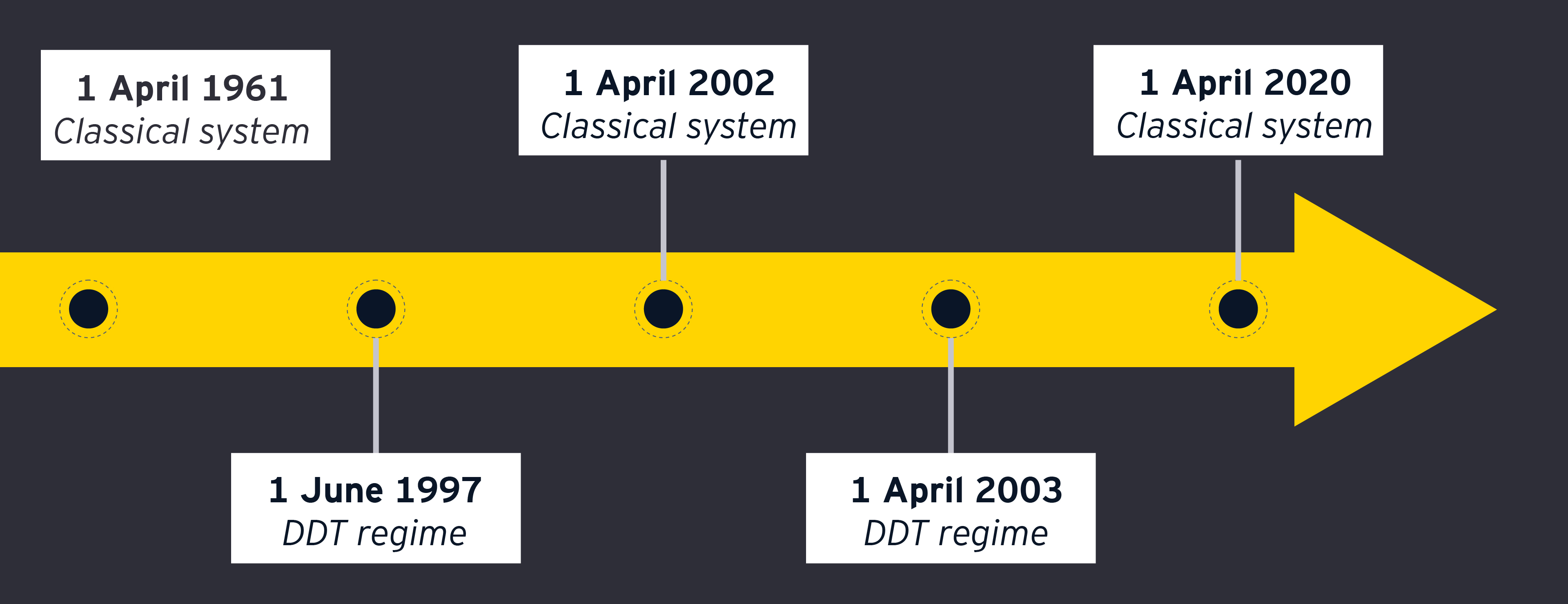

Web Mathpal also said that REITs are bound to pay 90 per cent their rental income as dividend to the REIT investors. Web Under the erstwhile Section 115-O of the Income-tax Act dividend distributed by a domestic company was subject to dividend distribution tax DDT in the hands of. Web There are several positives when it comes to the extant tax framework for REITs in India even when compared to developed REIT regimes.

The Reit is also exempt from tax on its rental income which it may have. Web Most REITS pay out a minimum of 100 percent of their taxable earnings to their shareholders.

How To Invest In Reits And What Are The Benefits Read Here To Know More

These 3 Perfect Reit Dividends Are Still On Sale Nasdaq

Overview Reits Listed In India

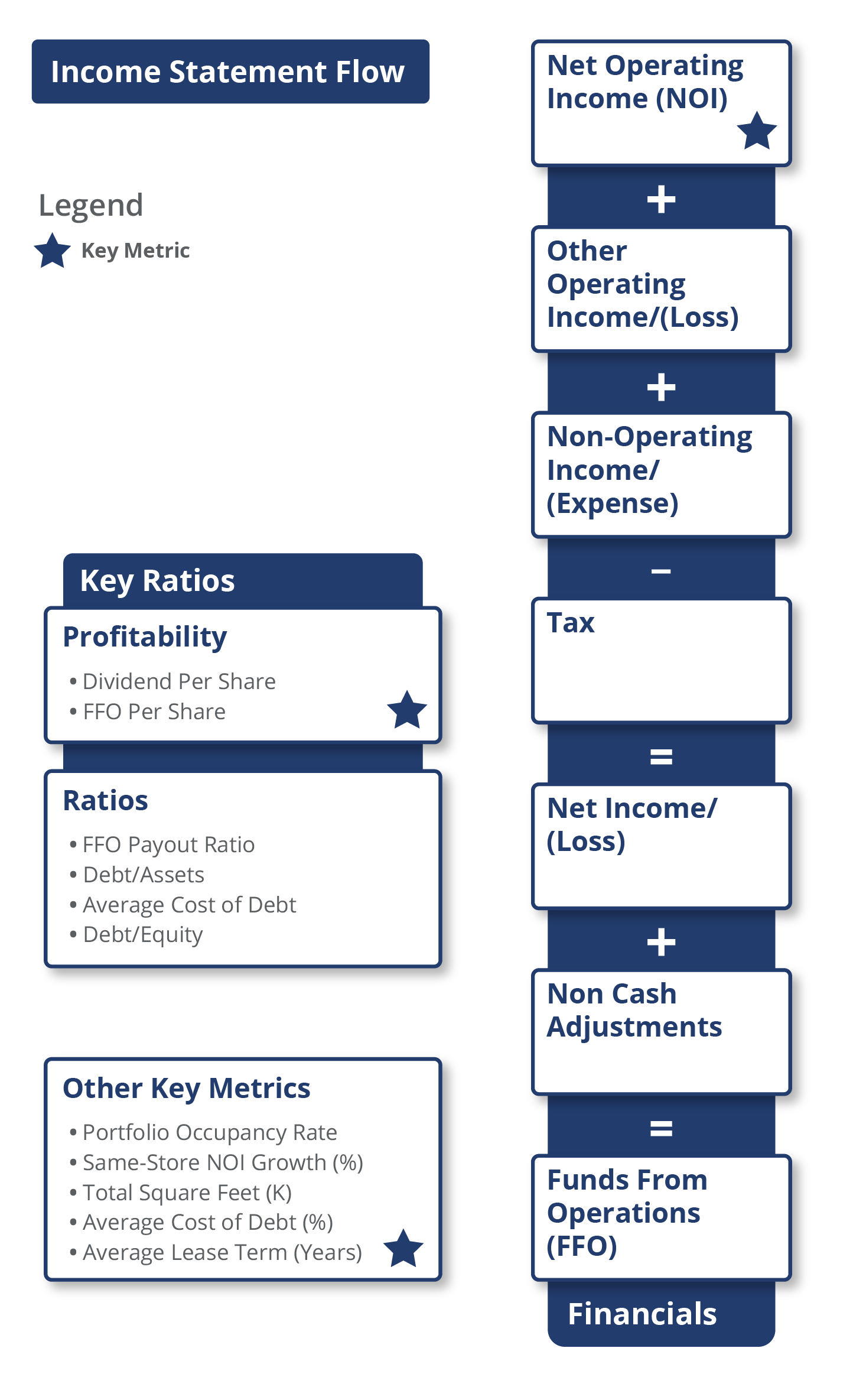

Guide To Retail Reits Industry Kpis Visible Alpha

Dividend Income Investing Guide What Is Dividend Income

Know About Reit Real Estate Investment Trust In India Learn2finance

One More Push Required By Govt For Popularising Reits Real Estate News Et Realestate

Which Is The Best Reit In India Capitalmind Better Investing

Reits In India Structure Eligibility Benefits Limitations

The Taxman Cometh Reits And Taxes

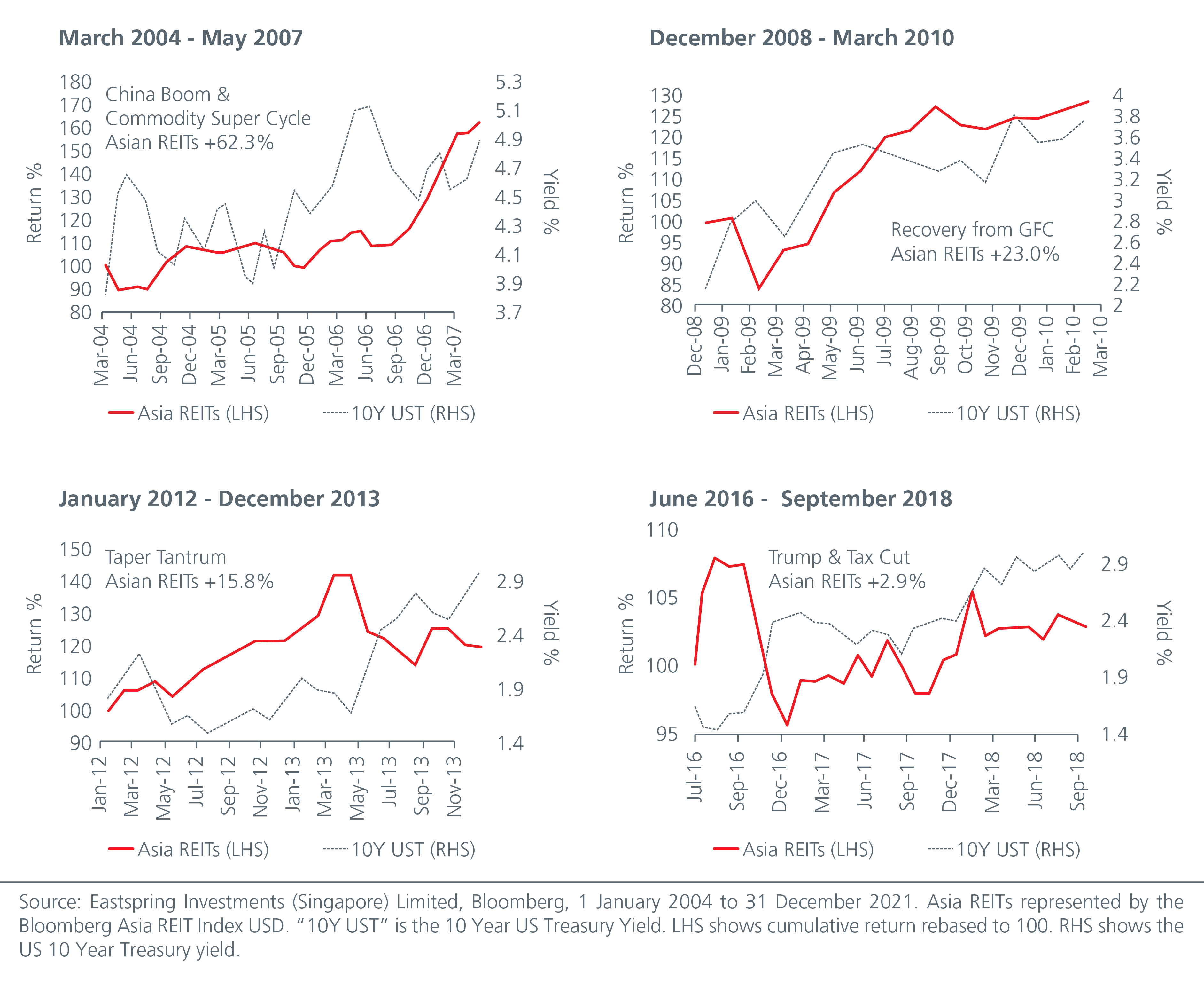

Income Investing In Asia Building Resilience With Asian Reits And Dividends

What Is Reit India Whether To Invest Or Avoid Getmoneyrich

Reit Investments In India Random Dimes

Dividend S Tryst With Taxation Ey India

Embassy Office Parks Should You Invest In India S First Reit Srinivesh